With growing frequency, colleges and universities across the U.S. are turning to mergers and acquisitions to address fiscal challenges, low enrollment, a shrinking population, tough competition, stagnant state funding, a shift to online learning, and more. A 2020 survey of college and university presidents showed more than 16% explored a merger or acquisition the prior year (the percentage is likely higher, but not reported due to confidentiality). While mergers and acquisitions may not be right for every institute of higher education, the associated pros and cons warrant consideration.

Data from the National Center for Education Statistics shows the higher education industry continues to shrink, even before the anticipated demographic cliff hits in 2025. (Learn more about college and university closings, mergers, and acquisitions by state using Higher Ed Dive’s tracking tool.) This has a profound impact on costs, revenue, alumni relations, and future planning.

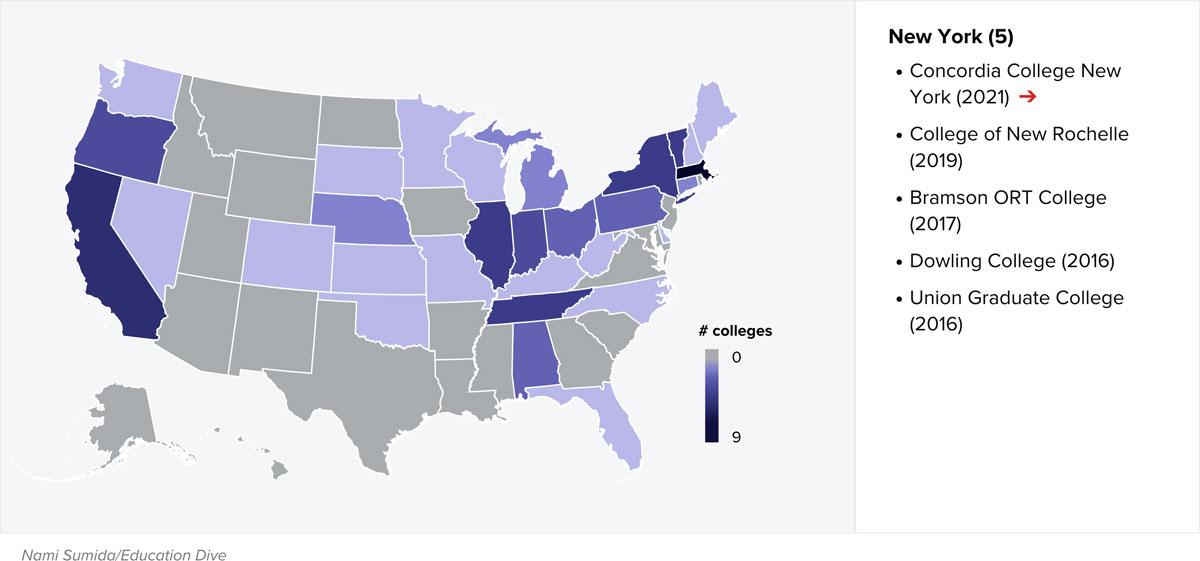

College closings and mergers by state

Each state is colored by how many of its public and private nonprofit colleges have closed or merged, or have announced plans to, since 2016. Click on a state to filter the list.

So, what factors are enticing so many college presidents and boards of trustees to consider a merger or acquisition?

Mergers and acquisitions can can offer efficiencies and economies of scale, allowing for shared services, campuses, affiliations, partnerships, and branding, as well as staff redeployment. They can help promote growth, by expanding degree and class offerings, entering new markets, and filling new/emerging needs in the local community and society overall (i.e., technical training for manufacturing and construction). There’s also opportunity to increase value for students and prospects while improving competitiveness for the institution(s), as a result of greater brand recognition, an expanded alumni base, broader internships and job placement opportunities, enhanced technology, increased networking potential, and more.

What’s more, mergers and acquisitions can help a college or institution expand its geographic footprint inside the U.S. and out. Plus, they enable fast acquisition of offerings, infrastructure, technology, and facilities by employing a “buy” rather than a “build” strategy.

On the other hand, there are some downsides to consider. Research suggests mergers and acquisitions lead to tuition and fee increases of five to seven percent. Although there are initial savings achieved through economies of scale (no need for duplicate staff or duplicate facilities and equipment), this represents one-time savings versus ongoing.

There’s also concern that mergers and acquisitions can lead to the potential loss of an institution’s identity and in-person learning, as well as enrollment. Alternative curriculum or approaches to education that give students options based on the way they learn may suffer. It’s like replacing a local establishment with a big box store. If students or prospects believe a merger or acquisition is being driven primarily by an institution’s financial issues, there can be a negative impact on applications and income.

Mergers and acquisitions of higher education institutions have unique challenges that aren’t shared by the corporate world. Accrediting bodies, faculty and alumni can all have an impact, as can national, state, and local governments. According to Statista, almost 79 percent of higher education spending comes from private sources like alumni who, at times, have led to a merger being called off.

As is the case for many industries, the COVID pandemic and ensuing changes (i.e., the unprecedented adoption of online learning) are facilitating disruption in higher education. As leadership of these institutions chart their paths forward, consideration of the pros and cons of mergers and acquisitions should be part of their planning. As noted by the Teachers Insurance and Annuity Association of America (TIAA), “Rather than a last resort, mergers and acquisitions can be part of a proactive strategy to help realize institute of higher education missions.”

If you need help understanding the tax and accounting implications of mergers and acquisitions, call RBT CPAs. We’re also available to handle all your tax and accounting needs, so you can focus on what’s important to your institution – learning and the future.