Thought Leadership Articles

Recent Posts

- The One Big Beautiful Bill Act: Key Provisions Impacting the Real Estate Industry

- When Should You Start Planning a Will?

- Addressing Supply Chain Challenges in 2025

- The One Big Beautiful Bill Act: Tax Law Changes Veterinarians Should Know

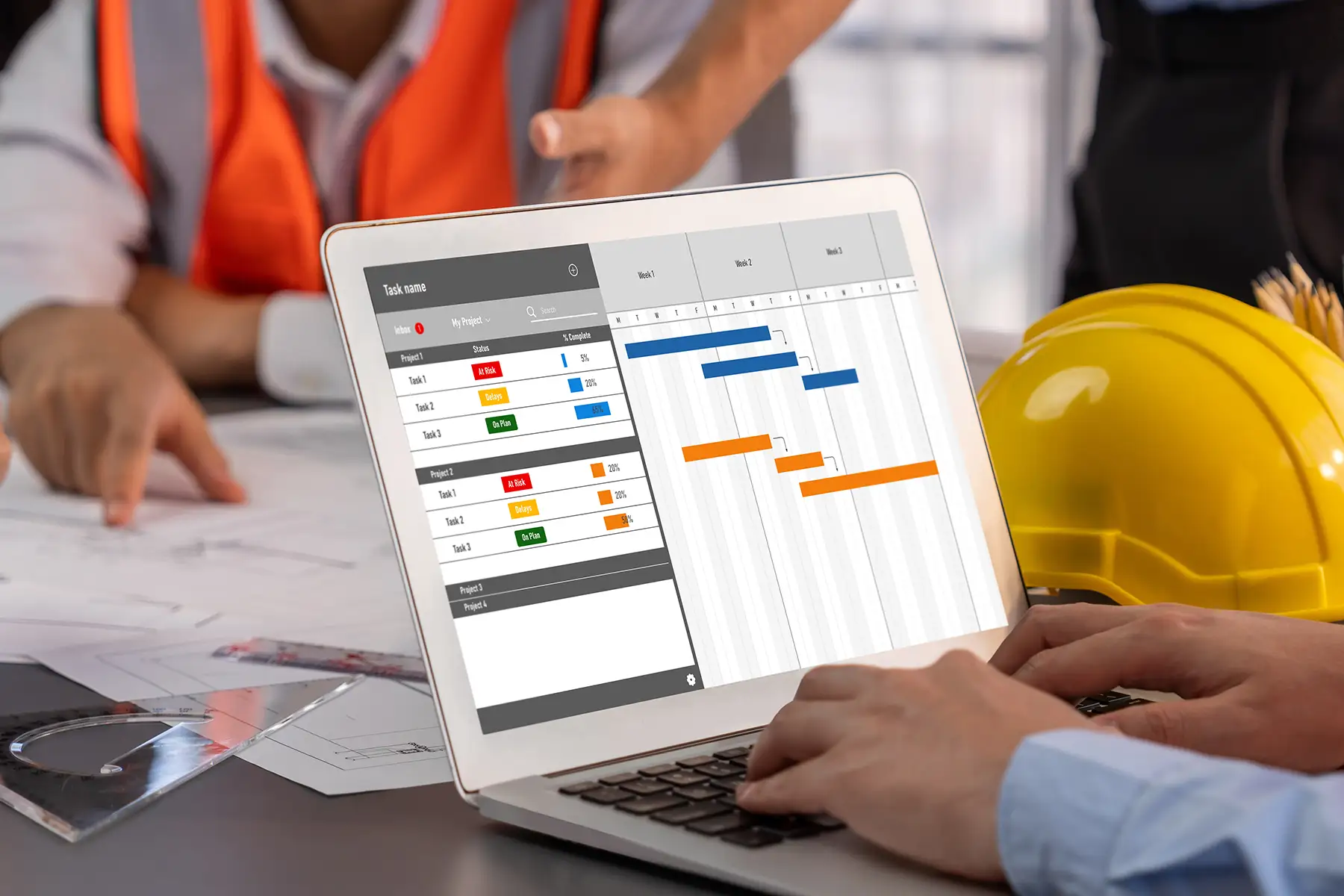

- Choosing the Right Software for Project Management and Accounting

Categories

Voted Best Accounting Firm

in the Region!

Voted Best Tax Preparers

in the Region!

Voted Best Financial Planners

in the Region!

Voted Most Innovative

Work Place!

Voted Best Overall Employer