Small businesses are at the heart of New York’s economy, culture, and communities. According to Empire State Development, “small businesses make up 98 percent of New York State businesses and employ 40 percent of New York’s private sector workforce.” And yet, small businesses, along with minority and women-owned businesses (MWBEs), often face limited access to capital, inhibiting their growth and ability to take on new projects. In response to these challenges, New York developed the Linked Deposit Program as a way of making low-interest loans available to small businesses and MWBEs, supporting these vital businesses and encouraging economic growth in the state.

What is the Linked Deposit Program?

The Linked Deposit Program (LDP) is an economic development initiative under which eligible businesses can obtain commercial loans at an interest rate 2-3% lower than the prevailing rate. The reduced rate is guaranteed to borrowers for a period of four years. Lending institutions—which include commercial banks, savings banks, savings and loan associations, credit unions, Pursuit Lending, and farm credit institutions—receive a deposit of State funds at a similarly reduced interest rate. The deposit is returned to the State at the end of the four-year term of the program.

What is the purpose of the Linked Deposit Program?

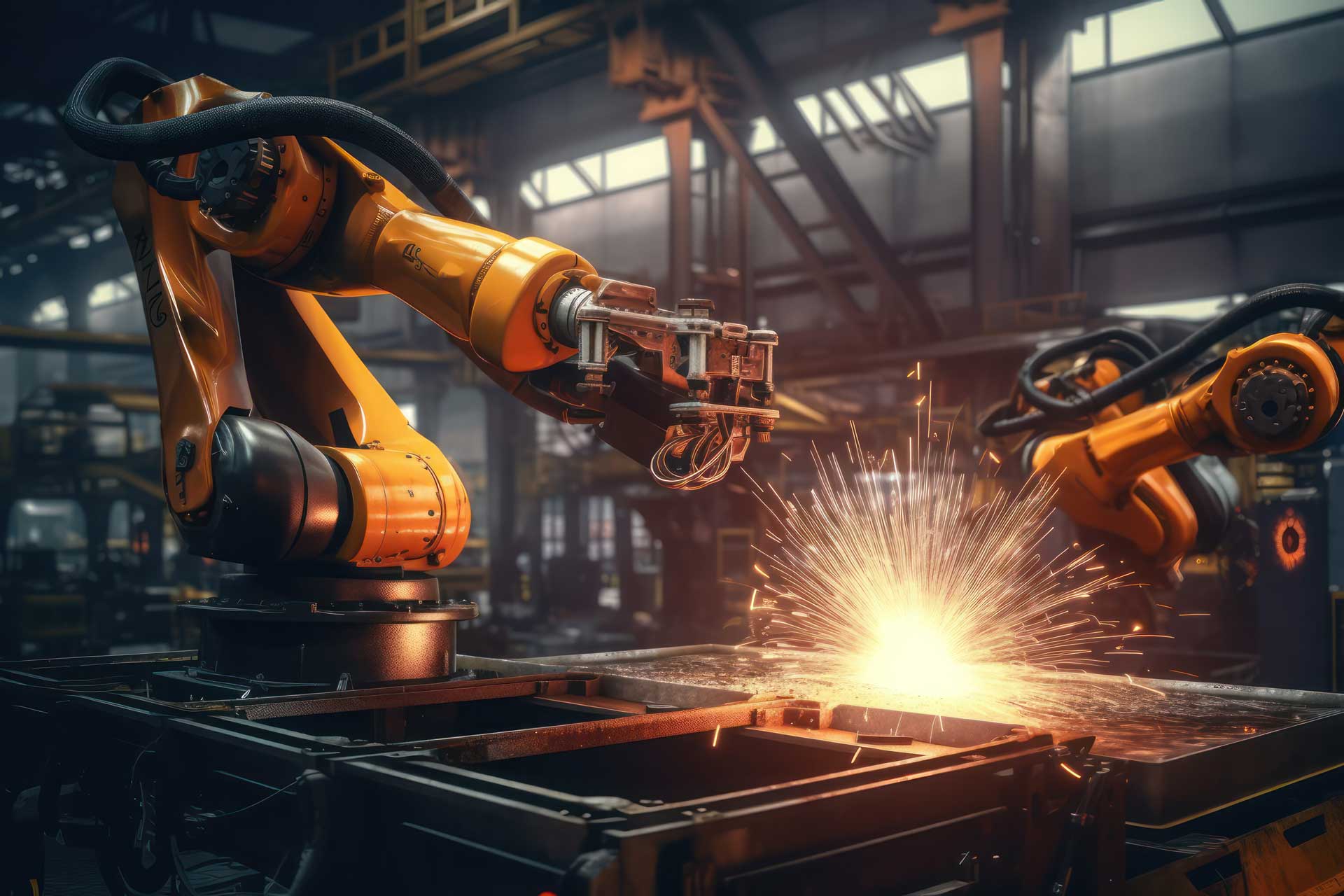

By offering reduced interest rates on commercial loans, this program makes funding more accessible to the state’s small businesses and minority and women-owned businesses, who may otherwise face difficulties obtaining financing. These businesses can use the loans to invest in improved operations, research and development, market expansion, modernized technologies and equipment, renovations, facility expansions, and more.

Who is eligible for the program?

- Manufacturing firms with 500 or fewer full-time, NYS-based employees.

- Service businesses with 100 or fewer full-time, NYS-based employees. The business must be independently owned and operated and not dominant in its field.

What are the loan limits?

- An eligible business can have outstanding LDP loans totaling up to $6 million. There is no limit on the number of loans.

- The single deposit limit is $4 million. There is no minimum deposit.

- Total lifetime assistance cannot exceed $6 million, including renewals and prior deposits.

How can businesses apply for a Linked Deposit loan?

Eligible businesses can apply for the program at a participating lender (a list of participating lenders can be found here) or the New York Business Development Corporation. The lender then sends the application to Empire State Development for approval. The application can be found here.

How long is the approval process?

Once submitted, an LDP application will be approved or rejected within 28 days, but the average approval time is five business days. Incomplete applications result in longer processing times. Delays are most commonly caused by the following application errors: incomplete information, no statement describing how the project will improve the business’s competitiveness, an insufficient “impede” statement (statement describing how the project would be impeded without LDP assistance), or a missing NYS-45 form.

Want to learn more?

For a complete list of eligible applicants and projects, see the Linked Deposit Program Frequently Asked Questions. The FAQ page also specifies which firms qualify for 2% interest rate subsidies and which ones qualify for 3% subsidies, along with other helpful information. For additional insights and guidance, please don’t hesitate to reach out to our experts at RBT CPAs. RBT CPAs has been providing accounting, tax, audit, and advisory services to businesses in the Hudson Valley and beyond for over 55 years. Call us today to find out how we can be Remarkably Better Together.