In 2023, the IRS issued Revenue Ruling 2023-02, significantly impacting the transference of assets held in irrevocable trusts. If you are the owner of an irrevocable trust—or are planning to set up an irrevocable trust—you should meet with your accountant to assess the impact of this rule change on your estate plan.

What are the tax benefits of trusts?

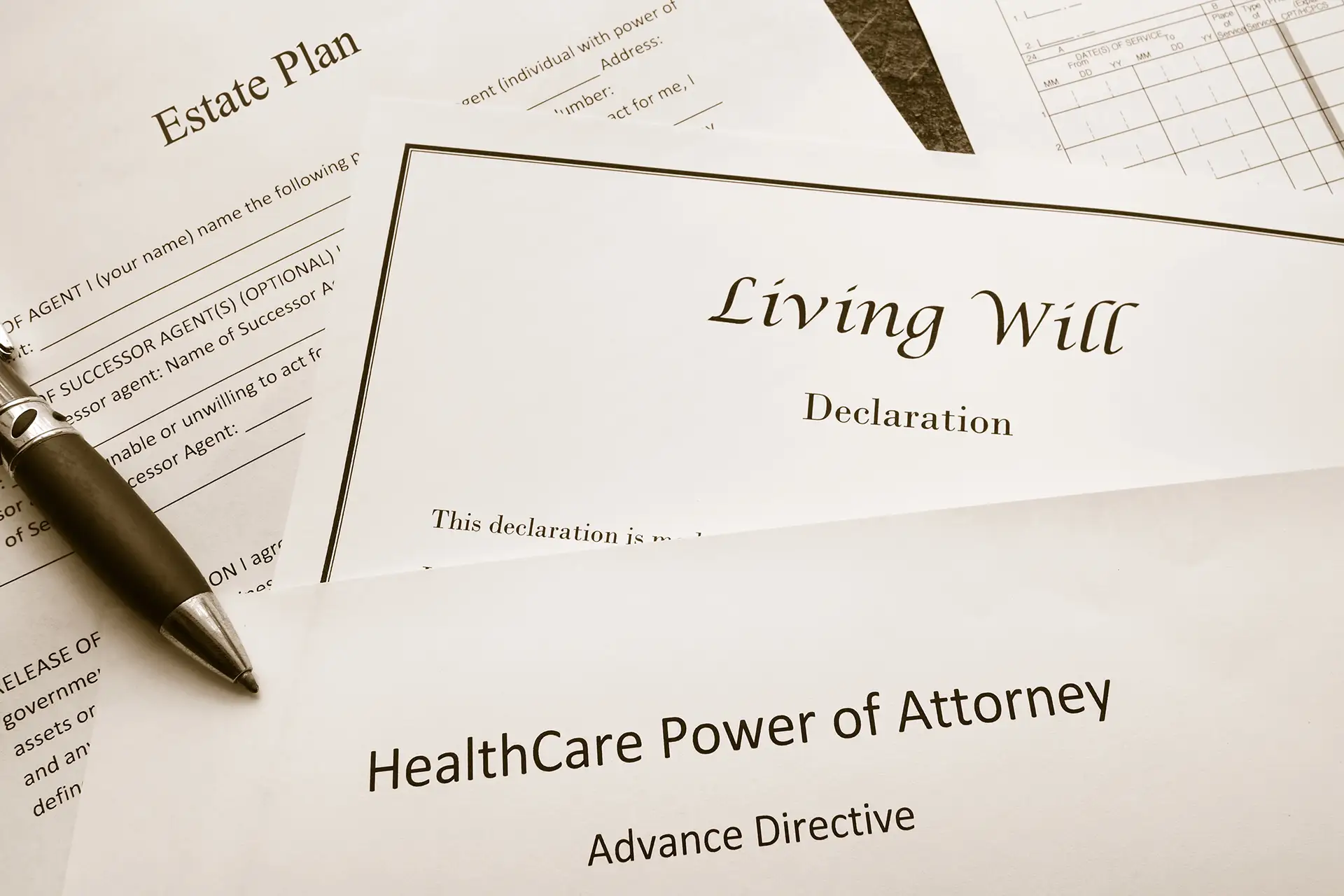

There are two basic types of trusts used to transfer assets to beneficiaries: revocable and irrevocable. Revocable trusts can be changed or revoked after they are created; the assets in a revocable trust remain a part of the grantor’s estate and are therefore subject to estate taxes. With few exceptions, irrevocable trusts cannot be changed or revoked. Depending upon the verbiage in an irrevocable trust agreement, transfers to the trust may be considered completed gifts; as such, they are not included in the grantor’s estate and are therefore exempt from estate taxes. If, by the terms of the trust, the grantor maintains the right to determine the beneficiaries and the beneficial enjoyment of the trust assets, the grantor may be deemed not to have made completed gifts when the assets were transferred to the trust. If this is the case, when the grantor passes away, the trust assets will be included in the grantor’s estate and may be subject to estate taxes. An irrevocable trust can be a useful component of a person’s estate plan and long-term tax strategy; however, careful consideration must be given to the terms of the trust agreement.

Up until 2023, assets in revocable trusts and many irrevocable trusts benefited from a provision known as the “step-up in basis” upon the death of the grantor. Under the step-up in basis provision, when the grantor dies, the tax basis (the price originally paid) of a trust’s assets “steps up” to the fair market value at the time of the grantor’s death. What is the significance of this? The step-up in basis provision greatly reduces or eliminates capital gains taxes for the trust’s beneficiary, as he/she is only required to pay taxes on the increase in value of the trust’s assets occurring after the original owner’s death, not the increase in value occurring during the lifetime of the owner.

What changed with Revenue Ruling 2023-02?

With the issuance of Revenue Ruling 2023-02, however, the IRS clarified that any assets held in an irrevocable trust that are not included in the owner’s taxable estate do NOT qualify for a step-up in basis. In other words, an irrevocable trust that excludes the trust assets from an individual’s estate can no longer reap the dual benefits of an estate tax exemption and a step-up in basis. This change, of course, may have significant tax implications for grantors of irrevocable trusts and their beneficiaries.

Assets in many more irrevocable trusts now maintain a carryover basis, as opposed to a stepped-up basis, meaning the assets retain the tax basis of the original owner. Therefore, the capital gains of the gifted assets are calculated using the original tax basis, resulting in higher capital gains taxes for the beneficiary.

This change will begin to impact more people starting in 2026, when the current high exemption threshold for estate taxes ($13.99 million in 2025) is due to sunset. On January 1, 2026, if no actions are taken to change the law, the exemption threshold will reset to approximately $7 million, meaning many more families and individuals will be subject to estate taxes after that point.

Is it time to review your estate plan?

Whether an irrevocable trust remains a tax-beneficial option for transferring your estate depends largely on your individual circumstances. It is important to carefully weigh the tax advantages and disadvantages of the provisions of irrevocable trust agreements with the help of an experienced financial professional.

At RBT CPAs, our Gift, Estate, and Tax practice professionals help clients define their financial goals, understand and weigh their options, and develop an estate plan. We can review legal documents, such as trust agreements, to ensure they are tax-beneficial and aligned with your goals. We are available to meet with you annually to review your estate plan, ensuring it’s on track to reflect your wishes and is adapted to address any tax law changes, such as the ruling discussed in this article.

To learn more about how we can be Remarkably Better Together, please don’t hesitate to give us a call today.